Page Content

Proactive approach key to maintaining benefits into retirement

Your mind is made up! You are retiring. You have worked out the pension details with the Alberta Teachers’ Retirement Fund (ATRF), have booked a trip and know what you will be doing with all the time you will have on your hands.

Your mind is made up! You are retiring. You have worked out the pension details with the Alberta Teachers’ Retirement Fund (ATRF), have booked a trip and know what you will be doing with all the time you will have on your hands.

Don’t be an Elizabeth! Be a Sally. Thinking about benefit coverage should be a part of your overall retirement planning, and there are solutions that are quite affordable. Leaving it until the last minute will create problems as you may have a lapse in coverage.

In order to qualify for early retiree benefits, you must be over the age of 50 when you retire. You must also have had coverage with the Alberta School Employee Benefits Plan (ASEBP) for a period of five years immediately prior to your retirement date. ASEBP also requires you to be a resident of Canada with appropriate provincial health-care coverage. If you fulfill those criteria, you qualify.

Applying for early retiree benefits is simple. When you submit your letter of resignation, your school board will provide you with an application to maintain benefit coverage. Fill out the form, attach a photocopy of your birth certificate and the ball is rolling to your early retirement benefit coverage with ASEBP. Typically, the paperwork should be filed about 30 days prior to the expiry of your employer health benefits. Failure to submit an application before the expiry of your current coverage could leave you vulnerable with reduced benefits as you will be considered a new or late applicant.

Through work by teachers negotiating on your behalf, most collective agreements provide ASEBP coverage for dental, extended health care, vision, life and accidental death and dismemberment insurance as well as extended disability benefits (EDB). As a retiree, you can maintain all coverage except for EDB. As each of these coverage areas has its own plan, you can choose the coverage you would like to maintain in retirement.

The cost of your benefit plan will vary depending on the specific plans outlined in your collective agreement. Your current employer or ASEBP can provide you with detailed information, or you can check your latest pay stub. Premium costs that you and your employer contribute to each plan on a monthly basis are typically listed in the deductions section of your pay stub. Premiums are adjusted annually, so there will be fluctuations in your benefit costs. These fluctuations will continue once you retire, so be aware that the changes may happen every Sept. 1.

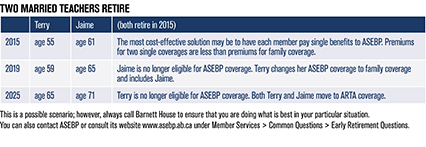

Premium costs also vary from one individual to the next, so expect to have different premiums than your colleague who retired last year. Your insurance premiums, whether they be for life coverage or accidental death and dismemberment, are based on your salary going into retirement. The premium cost will be higher for someone with six years of teacher education and an administrative designation than for a classroom teacher with a four-year degree. Extended health care, vision and dental premiums are also dependent on whether you have single or family coverage. You may have decisions to make around whether to have single or family coverage, depending on your marital status and whether or not you have dependent children when you retire.

ASEBP provides a seamless transition to monthly premium payments. When applying for early retiree coverage, you will enclose a blank cheque marked “void.” On a monthly basis an electronic transaction will take the money out of your account, so you won’t accidentally forget and find yourself without coverage.

Once retired, you are no longer an employee of your school board and therefore no longer covered by the collective agreement. Because of this, you will no longer have access to a health spending account or wellness spending account if that was part of your benefit package with your employer. ASEBP early retiree benefits also end when you turn 65.

Welcome to ARTA

At age 65, you become eligible for the Alberta Retired Teachers’ Association (ARTA) benefit plan, which is administered by ASEBP. As with early retirement benefits, it is better to apply sooner rather than later. You must, however, apply within a 60-day enrollment window after your previous benefit plan expires, or a medical questionnaire has to be filled out and your coverage may be denied.

There are four options with ARTA benefits: Health Wise, Health Wise Plus, Total Health and Ultimate Health. The latter two packages include emergency travel coverage. Travel coverage is limited to 92 days per trip out of your province of residence, but you can take as many trips as you want. If you wish to take a single longer trip, increased coverage may be purchased in 15-day increments.

Some benefits in ARTA plans are actually better than what is available in early retirement plans. For example, where ASEBP Vision Care Plan 3 allows for a $350 maximum every two years, ARTA’s Health Wise Plus plan has a $550 maximum.

As benefits are part of your total compensation package as a teacher, it is important that you consider benefit coverage going into retirement. Check out the ASEBP website, call ASEBP with specific questions or contact the Alberta Teachers’ Association’s Teacher Welfare to get clarification on the benefit coverage available going into retirement.

Fred Kreiner is an executive staff officer in the Teacher Welfare program area of the Alberta Teachers’ Association.

ELIZABETH:

Retired at last. Pension money coming in; a trip is planned; life is good. I have to refill my prescription before I head out on that cruise I booked. Without my Alberta School Employee Benefit Plan (ASEBP) coverage I have to pay for my prescription out of pocket. The cost of medications I take on an ongoing basis was not a part of my budget planning because they had never been an out-of-pocket expense when I was teaching. My whole retirement is suddenly in jeopardy! Ahhh!

SALLY:

When thinking about retirement, I realized that my diabetes medication could be costly, so I called my benefit provider. I learned about early retiree benefit coverage. I included the premium costs when calculating my retirement budget. Now I can get my medications covered just as I did when I was teaching, and I can focus on enjoying my retirement.

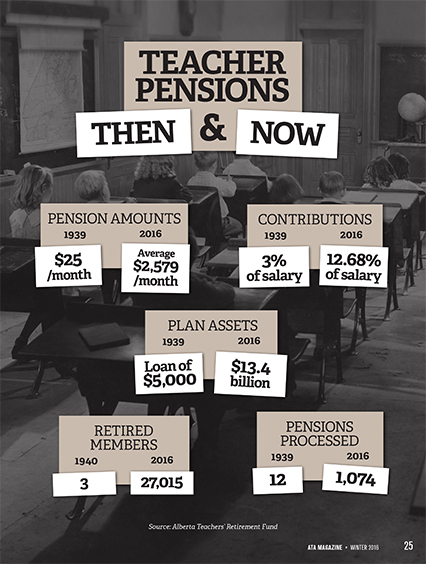

Source: Alberta Teachers’ Retirement Fund